In demonstration of their shared commitment to advancing sustainable economic growth, Bangladesh and Indonesia engaged in a

high-level exchange on sustainable finance. A delegation of senior representatives from Bangladesh`s Economic Relations

Division (ERD), Ministry of Finance, led by the Cabinet Secretary, and ERD

Additional Secretary, and supported by the United Nations Development

Programme (UNDP) and Impact Investment Exchange (IIX), visited Indonesian

capital Jakarta from 24 to 27 February, said a press release.

The delegation was led by Sheikh Abdur Rashid, Cabinet Secretary, Government

of Bangladesh.

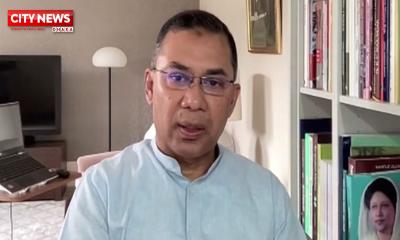

AKM Sohel, Additional Secretary, Economic Relations Division, Government of

Bangladesh; Razibul Islam, Joint Secretary, Economic Relations Division,

Government of Bangladesh; Ashfaqul Islam Mukut, Joint Secretary, Economic

Relations Division, Government of Bangladesh and other senior officials were

also present.

The visit aimed to gain insights from Indonesia`s pioneering success in

sustainable financing and thematic bonds, including Green and Sustainability

mechanisms.

The visit provided an opportunity for both nations to explore how financial

instruments such as Green Bonds, Sukuk, Orange Bonds, and other thematic

financing models can mobilize capital for national sustainable development.

The delegation engaged with Indonesia`s financial policymakers, bond issuers

and climate-aligned projects to understand how sustainability-focused finance

has been successfully scaled to drive economic growth while addressing

environmental and social priorities.

Sohel said Bangladesh is committed to building a sustainable and resilient

economy, and this collaboration with Indonesia is a vital step toward

unlocking innovative financial solutions through capital markets.

"By learning from Indonesia`s successful experience in green finance and

social and sustainability aligned investments, we aim to develop financial

mechanisms that will not only support our climate goals but also ensure

inclusive economic growth for all Bangladeshis," he added.

Indonesia has been recognized for its leadership in sustainable finance,

having introduced award-winning financial instruments such as the Green Sukuk

and sustainability bonds.

Both countries have demonstrated commitment to ensuring that investments are

directed toward the communities most affected by these issues, particularly

women and underserved populations, with Bangladesh looking to issue Green

Bond and their inaugural Orange Bond, recognizing that sustainability must

encompass more than just environmental concerns.

IIX, a global leader in gender-lens investing coupled with climate action, is

actively supporting both countries in structuring their Orange Bond

frameworks, providing technical expertise, and facilitating access to impact-

driven capital markets.

At a welcome dinner hosted by IIX, the delegation engaged with key

organizations leading Indonesia`s sustainable finance initiatives across

public, private, and philanthropic sectors.

Professor Durreen Shahnaz, CEO and Founder of IIX, said sustainable finance

must be both inclusive and catalytic, ensuring that capital reaches those who

need it most.

"The introduction of Orange Bonds in Bangladesh and Indonesia marks a bold

step toward gender-responsive financial innovation, demonstrating how South-

South partnerships can lead the charge in mobilizing capital for impact at

scale. IIX is proud to support this regional knowledge exchange and looks

forward to seeing these insights transform into actionable outcomes that

benefit women and underserved communities," he added.

The delegation`s visit reinforced Bangladesh`s commitment to expanding its

sustainable finance market and integrating insights from Indonesia`s

experience in mobilizing private capital for social and environmental impact.

Both countries recognize that diversified, well-structured financial

solutions are essential for advancing national economic priorities and

achieving the Sustainable Development Goals (SDGs). Such financial solutions

are also crucial for funding climate change adaptation and mitigation actions

as enshrined in Bangladesh`s National Adaptation Plan (NAP) and Nationally

Determined Contributions (NDCs).

Comment :