Ambani’s Reliance considers buying out Revlon in the U.S.

প্রকাশিত: জুন ১৭, ২০২২, ১১:৩৩ পিএম

Indian conglomerate Reliance Industries is considering buying out Revlon Inc in the United States. Report: Reuters.

The global cosmetics giant Revlon on Thursday (17 June) filed for bankruptcy as it fell victim to global supply chain disruptions that pushed up raw material costs and prompted vendors to demand upfront payments.

Mukesh Ambani-led Indian oil-to-retail conglomerate Reliance and Revlon however did not immediately respond to Reuters’ requests for comment.

The 90-year-old nail polishes and lipsticks company in recent years has lost shelf space and sales to startups backed by celebrities such as Kylie Jenner's Kylie Cosmetics and Rihanna's Fenty Beauty.

Revlon said its supply chain disruptions in the spring prompted intense competition for ingredients used to make its products. At the same time, vendors that traditionally offered up to 75 days for payment began demanding cash in advance of new orders, while labour shortages and inflation added to its troubles, it said.

The COVID-19 pandemic has lengthened ship delivery times since 2020, pushing up freight costs, while the Russia-Ukraine conflict and lockdowns in Shanghai have added to supply chain disruptions this year.

The shares had halved in market value between last Thursday and close of trading on Wednesday.

Revlon, which was formed in 1932 by brothers Charles and Joseph Revson and Charles Lachman, started off selling nail enamel. It was sold in 1985 to MacAndrews & Forbes - which remains the controlling shareholder and is owned by Ron Perelman - and went public 11 years later.

HA

ইউটিউব চ্যানেল সাবস্ক্রাইব করুন

অর্থ ও বাণিজ্য সম্পর্কিত আরও

-

আন্তর্জাতিক অপরাধ ট্রাইব্যুনালে

আন্তর্জাতিক অপরাধ ট্রাইব্যুনালেজুলাই গণহত্যার দুই মামলায় আনুষ্ঠানিক অভিযোগ দাখিল এ মাসেই

-

আওয়ামীপন্থি ৯৩ আইনজীবীর আদালতে আত্মসমর্পণ

-

চাটমোহরে অটোভ্যান উল্টে প্রাণ গেল চালকের

-

মানবপাচার রোধে বাংলাদেশ নিজ প্রতিশ্রুতিতে অটল: স্বরাষ্ট্র উপদেষ্টা

-

নির্বাচনের সব কাজ ভালোভাবে এগোচ্ছে: সিইসি

-

প্রতারণার মামলায়

প্রতারণার মামলায়ইভ্যালির রাসেল-শামীমার ৩ বছর কারাদণ্ড

-

ভারতে ভয়াবহ বাস দুর্ঘটনা, ছিলেন ৭০ জনের বেশি বাংলাদেশি

-

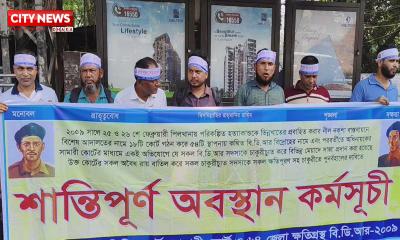

পিলখানার সামনে অবস্থান নিয়েছেন চাকরিচ্যুত বিডিআর সদস্যরা

-

কিশোরগঞ্জে ধান কাটার উৎসব

-

ট্রাম্প প্রশাসনের শুল্কারোপের প্রভাব সামাল দেয়া কঠিন নয়: অর্থ উপদেষ্টা

-

চীনের গণমাধ্যমে দেয়া সাক্ষাৎকারে যা বললেন প্রধান উপদেষ্টা

-

এবারের ঈদযাত্রা স্বস্তির ছিল, বলছেন যাত্রীরা

-

বার্সাকে আটকে দিল বেতিস, হেরেও স্বস্তিতে রিয়াল

-

ফ্ল্যাট ইস্যুতে ফের ‘মিথ্যাচার’ করার অভিযোগ টিউলিপ সিদ্দিকের বিরুদ্ধে

-

৪৭০ কোটি ডলার ঋণের অর্থছাড় ইস্যুতে আইএমএফ প্রতিনিধিদলের সঙ্গে বৈঠক আজ

-

‘পরকীয়ায় জড়ালে পাথর নিক্ষেপে হত্যার আইন করব’

-

শুল্ক ইস্যুতে যুক্তরাষ্ট্রের সঙ্গে সরাসরি যোগাযোগ করবেন প্রধান উপদেষ্টা: বাণিজ্য উপদেষ্টা

-

রাজধানীতে ঝড়-বৃষ্টি, ধুলার কারণে অস্বস্তিতে নগরবাসী

-

ইসরায়েলের বিরুদ্ধে সব মুসলিমদের জন্য জিহাদের ফতোয়া জারি

-

মার্কিন শুল্ক ইস্যুতে প্রধান উপদেষ্টার জরুরি সভা শুরু

-

ইরান হামলায় মধ্যপ্রাচ্যের আকাশও ব্যবহার করতে পারবে না যুক্তরাষ্ট্র

-

ইসরায়েলের বিরুদ্ধে সব মুসলিমদের জন্য জিহাদের ফতোয়া জারি

-

চাঁদ দেখা গেছে, কাল ঈদ

-

সেভেন সিস্টার্স ইস্যুতে বাংলাদেশকে ‘ভেঙে ফেলার’ হুমকি ভারতীয় নেতার

-

ঈদের দিনে দুই বাসের সংঘর্ষে প্রাণ গেল ৫ জনের

-

স্বাচিপ নেতার বদলি আটকাতে সাজানো মানববন্ধনের অভিযোগ

-

চীনে সেভেন সিস্টার্স নিয়ে কী বলেছিলেন ড. ইউনূস, ভারতে তোলপাড় কেন?

-

ভাঙ্গায় ২ মোটরসাইকেলের সংঘর্ষে ২ যুবক নিহত

-

এবার মুক্ত পরিবেশে মানুষ ঈদ উদযাপন করছে: মির্জা ফখরুল

-

খালেদা জিয়ার ‘পূর্ণাঙ্গ স্বাস্থ্য পরীক্ষা’ শুরু হয়েছে: ডা. জাহিদ

-

আমি একটা সংগঠন করতাম, যেটা বলতে এখন লজ্জা হয়: জামায়াত আমির

-

রাষ্ট্রপতিকে অপসারণ করল আদালত, ৬০ দিনের মধ্যে নির্বাচন

-

এশিয়ার কোন দেশে কত শুল্ক আরোপ করলেন ট্রাম্প?

-

দুপুরের মধ্যে ৬০ কিমি বেগে ঝড়ের পূর্বাভাস

-

ব্যাংককে ইউনূস-মোদি বৈঠক

ব্যাংককে ইউনূস-মোদি বৈঠকসীমান্ত হত্যা বন্ধ ও তিস্তার পানির ন্যায্য হিস্যা চাইল বাংলাদেশ

-

সংস্কার সংস্কারের মতো চলবে, নির্বাচন নির্বাচনের মতো: মির্জা ফখরুল

-

হাঙ্গেরিতে পা রাখলেই নেতানিয়াহুকে গ্রেপ্তারের আহ্বান হিউম্যান রাইটস ওয়াচের

-

থাইল্যান্ড ও ভুটানের প্রধানমন্ত্রীর সঙ্গে ড. ইউনূসের বৈঠক হবে বিমসটেকে

-

এসএসসি পরীক্ষা পেছানো নিয়ে যা জানালেন ঢাকা বোর্ডের চেয়ারম্যান

-

বিদ্যুতের খুঁটির সঙ্গে বাসের ধাক্কায় নিহত ৩